The Inflation Reduction Act: What does it mean to you?

- Senate Democrats on Sunday passed their climate, health and tax package, including nearly $80 billion in funding for the IRS. The bill passed the House on 8/12/22.

- The Inflation Reduction Act allocates $79.6 billion to the IRS over the next 10 years, with more than half of the money going to enforcement.

- More than half of the money is meant for enforcement, with the IRS aiming to collect more from corporate and high-net-worth tax dodgers. The remainder of the funding is earmarked for operations, taxpayer services, technology, development of a direct free e-file system and more. Collectively, those improvements are projected to bring in $203.7 billion in revenue from 2022 to 2031, according to recent estimates from the Congressional Budget Office.

- IRS Commissioner Charles Rettig said the $80 billion in funding would not increase audits of households making less than $400,000 per year.

- More than two-thirds of registered voters support boosting the IRS budget to strengthen tax enforcement on high-income taxpayers, according to a 2021 poll from the University of Maryland.

- The bill also addresses health care and raises revenue, the latter most prominently by a new 15% corporate minimum tax on financial statement, or “book,” income, which was slightly modified before the bill came to the Senate floor. It would also increase IRS funding, particularly for enforcement.

- The bill’s Title I, Subtitle C (§12001), would amend Sec. 36B to extend through 2025 widened eligibility for health care premium tax credits for taxpayers whose household income exceeds 400% of the poverty line and the calculation of the applicable percentage of premium assistance amount, both of which were temporarily provided under the American Rescue Plan Act, P.L. 117-2.

- Following is an at-a-glance list of the bill’s energy and climate Title I, Subtitle D, tax credit and other items:

- Clean electricity and reducing carbon emissions (Part 1)

- Clean fuels (Part 2)

- Clean energy and efficiency incentives for individuals (Part 3)

- Clean vehicles (Part 4)

- Investment in clean energy manufacturing and energy security (Part 5)

- Superfund (Part 6)

- Incentives for clean electricity and clean transportation (Part 7)

- Credit monetization (Part 8)

The Tax Cuts and Jobs Act (TCJA): How it impacts individuals at different stages of life.

The Tax Cuts and Jobs Act of 2017 (TCJA) passed in Dec. of 2017 and made dramatic changes to the rules for individuals that affect tax planning at all stages of life, beginning with 2018 tax returns. These changes require financial planners to reorient their thinking about the advice they offer to individual clients concerning life-stage matters. As this advice is being offered, keep in mind that there are some unanswered questions that await IRS guidance or additional legislative clarification.

Marriage and Divorce

Marriage Penalty

The “marriage penalty” is the additional taxes that a couple pays because of their filing status, as compared with the tax that would be owed if they were not married and filed as single. The new law makes some changes that reduce the marriage penalty. Starting in 2018, the first five marginal tax brackets for singles are half those for married persons filing jointly, as compared to only the two lowest brackets (10% and 15%) for 2017.

The marriage penalty has not been completely eliminated. For example, the same $10,000 cap on the itemized deduction for state and local taxes starting in 2018 applies for both married couples and singles.

Divorce

The tax treatment of alimony changes dramatically for divorce and separation decrees or agreements entered into or modified after 2018. Alimony will no longer be deductible, while payments to the recipient will no longer be taxable. Payments under existing decrees or agreements will continue to be deductible/taxable. Individuals with prenuptial/postnuptial agreements that were written with the expectation of deductibility but who divorce after 2018 may want to try to negotiate different terms than those provided in the agreements (e.g., additional property settlements) to arrive at results acceptable to both parties.

Children

The dependency exemption for a child, which was $4,050 in 2017, has been eliminated for 2018 through 2025. The rules for determining a dependent continue to come into play for various purposes, however, such as the child tax credit, which has been greatly enhanced. The credit, which can be claimed for a child under age 17 at the end of the year, will double to $2,000 in 2018, and $1,400 of the credit is refundable. What’s more, the income phaseouts for claiming the credit have been raised considerably, making more parents eligible. There is also a new $500 nonrefundable child tax credit for a qualifying dependent who is not a qualifying child (e.g., a child living with and supported by parents but too old to be a qualifying child).

There were proposals to repeal the adoption credit and the exclusion for adoption assistance, as well as the exclusion for dependent care assistance, but they were not included in the final law.

Working Children

The rules for determining the standard deduction for a child who works have not changed. For 2018, the deduction is the greater of $1,050 or earned income plus $350 (but not more than $12,000). A child who works can continue to make contributions to an IRA or Roth IRA.

The computation of the tax on unearned income of a child, however, has been changed. Instead of figuring this tax using the parent’s highest tax rate, starting in 2018 it will be based on the rates for trusts and estates. Parents can continue to opt to report a child’s unearned income as their own under certain conditions. This election must be reexamined in light of all other changes impacting parents’ returns.

Education

In general, the tax-advantaged plans for education—Coverdell education savings accounts (ESAs) and IRC section 529 plans—continue to be available. There have, however, been some changes to note.

529 plans.

Previously, if parents or grandparents wanted to use tax-advantaged savings plans to pay for primary and secondary school, they had to use a Coverdell ESA. Starting in 2018, 529 plans can be used for this purpose. Up to $10,000 can be withdrawn tax free annually to pay for primary and secondary school (public, private, or religious). The limitation applies on a per-student basis, so if a student is the beneficiary of multiple 529 accounts, only a total of $10,000 can be withdrawn tax free in one year from one or more of these accounts. From a planning perspective, given the ever-rising cost of higher education, it probably is advisable to allow funds in 529 plans to grow tax deferred to pay for college or graduate school.

Funds in 529 plans can be rolled over tax free to Achieving a Better Life Experience (ABLE) accounts for disabled individuals. The amount rolled over counts toward the annual contribution limit, which is the same as the annual gift tax exclusion ($15,000 in 2018). Other changes to ABLE accounts are discussed below.

Paying For Education

The above-the-line deduction for tuition and fees expired at the end of 2016 and has yet to be extended. Nonetheless, the TCJA did not repeal this deduction (despite proposals to do so), which means that an extender bill may restore the deduction. A proposal to repeal the exclusions for tuition reduction, interest on U.S. savings bonds to pay for higher education, and employer-paid education assistance were not included in the final measure.

No changes were made to the American Opportunity Credit and the Lifetime Learning Credit, which will continue to apply to help defray the cost of higher education.

Paying Off Student Loans

No changes were made to the above-the-line deduction for student loan interest. The same $2,500 annual limit applies; the modified adjusted gross income limits on eligibility for the deduction continue to be adjusted annually for inflation. The proposal to eliminate this write-off was not included in the final law.

Under the TCJA, student loans that are canceled on account of death or disability are not treated as taxable cancellation of debt income.

Changing or Losing Jobs

The job market currently favors employees, with companies competing for talent with increased wages and enhanced benefits. Still, if an employee changes jobs after 2017, the deduction for expenses of resumés, travel, and other work-related costs is no longer available as an itemized deduction.

Relocating to Another State

America continues to be a highly mobile society, and this likely will not change under the new tax law. Still, individuals should be advised about how new rules under the TCJA will impact them.

Moving Expenses

The above-the-line deduction for moving expenses has been eliminated starting in 2018 (other than for active members of the military who relocate under military orders), meaning that employers cannot reimburse employees for these costs on a tax-free basis.

State Income Taxes

While all state and local taxes are deductible in 2017, starting in 2018 there will be a $10,000 cap on the itemized deduction for property taxes and state and local income or sales taxes. This new cap may influence a decision on whether or where a taxpayer chooses to relocate. The following states have no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming. The following states have no sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon.

Investments

Investment decisions will continue to factor in tax results. A proposal to make interest on municipal bonds taxable was not included in the final law. But the reduction in individual tax rates will diminish the value of tax-free interest on municipal bonds.

While the tax rates on individuals have been reduced starting in 2018, the tax rates on qualified dividends and long-term capital gains remain unchanged at 0%, 15%, and 20%. What has changed is the breakpoint at which these rates apply. Starting in 2018, the 0% rate applies for taxable income up to $77,200 on a joint return or for surviving spouses, $51,700 for heads of household, and $38,600 for singles and married persons filing separately. The 15% rate applies for taxable income up to $479,000 on a joint return or for surviving spouses, $452,400 for heads of household, $425,800 for singles, and $248,500 for married persons filing separately. These breakpoints will be adjusted for inflation after 2018.

There is a new opportunity for tax-free or tax-deferred capital gains on certain investments in opportunity zones. Opportunity zones are economically disadvantaged areas designated by the government. Investments are made through a qualified opportunity fund, defined as one in which at least 90% of the assets are qualified zone property.

Retirement

The TCJA did not directly change the rules for tax-advantaged retirement savings plans, such as 401(k)s, 403(b)s, and IRAs. Thus, the tax savings available through these plans continue to be important for individuals seeking future financial security.

One change of note is the end to the ability to recharacterize Roth IRA conversions. Thus, if an individual converts some or all of a tax-advantaged retirement savings plan to a Roth IRA in 2018 and the value of the account declines from the date of the conversion, the individual cannot undo the conversion. However, conversions made in 2017 can still be undone by October 15, 2018.

Another change in the TCJA, starting in 2018, is the ability of participants who took plan loans and then terminated employment to contribute the outstanding borrowed amount to the plan of a new employer and avoid a deemed distribution. The rollover to the new plan can be made up to the due date of the return (including extensions) for the year in which the plan loan offset occurs.

One indirect impact of the TCJA has been that some large employers have announced increases in their 401(k) contributions on behalf of employees. This can significantly add to retirement savings.

Caring for the Elderly and Disabled

Individuals who support their elderly parents can continue to deduct the medical costs they pay for their parents on their own returns, even though their parents are not dependents. For 2018, the threshold for itemizing out-of-pocket medical expenses will be 7.5% of adjusted gross income (AGI); this percentage applies regardless of the taxpayer’s age.

Of course, the increased standard deduction amounts that take effect in 2018 will likely lead to fewer taxpayers itemizing, making this provision less significant for some families. In addition, starting in 2019, the threshold for itemizing medical costs is set to rise to 10% of AGI.

ABLE Accounts

In addition to being able to roll over funds from a 529 plan to an ABLE account, as discussed above, there are two additional changes of note. The annual contribution amount (capped at the annual gift tax exclusion) has been temporarily increased by the lesser of the federal poverty line for a one-person household or the individual’s compensation for the taxable year. In addition, contributions to ABLE accounts can be used to claim the retirement saver’s credit. These changes will sunset in 2025.

Credit For Elderly and Permanently Disabled

The modest tax credit for a person age 65 or older or permanently disabled had been slated for repeal, but the final law retained it. It should be noted that only 48,502 of the 150.6 million individual income tax returns file (in 2015) claimed this credit.

Health Savings Accounts

There have been no changes to the rules for health savings accounts (HSA). Accordingly, withdrawals for nonmedical purposes from these accounts starting at age 65 remain penalty free.

Disaster Recovery

Under the TCJA, itemized deductions cannot be claimed for theft losses or for casualty losses other than those incurred in a federally declared disaster area. Individuals who suffer such disaster losses can continue to deduct them, but from a planning perspective, it is essential to review insurance policies (including flood insurance) to be sure of adequate coverage.

2016 Disaster Area Relief

The Disaster Recovery Act of 2017 provided special rules for victims of Hurricanes Harvey, Irma, and Maria. The TCJA provides some relief for a major disaster occurring after December 31, 2015 (“2016 disasters”), as well as for disasters occurring before January 1, 2018. See FEMA’s website for disaster designations (https://www.fema.gov/disasters).

From a tax perspective, there is still some tax relief available. The 10% early distribution penalty from tax-advantaged retirement savings plans does not apply to hardship distributions for 2016 or 2017 disasters, and a casualty loss deduction can be claimed as an additional standard deduction amount, without regard to the 10%-of-AGI threshold, but with a $500 reduction in the loss.

Keeping Up with Changes

The new law presents an opportunity for planners to have conversations with clients about evaluating their personal situations and changing their planning strategies. It is wise to continue the dialog as IRS guidance is issued, and to modify advice accordingly.

Planning Checklist

___ Determine the advisability of timing a marriage or divorce in light of TCJA changes.

___ Consider the terms in prenuptial/postnuptial agreements entered into in 2018.

___ Assess the tax savings, if any, that may result from the child tax credit.

___ Review investment holdings in light of the new breakpoints for the 0%/15%/20% rates for qualified dividends and long-term capital gains.

___ Review the options for saving and paying for education in light of TCJA changes.

___ Consider the options for paying for long-term care and savings in ABLE accounts.

___ Review insurance coverage in light of elimination of the deduction for theft and casualty losses (other than federally declared disasters).

The Employee Retention Credit of 2021 (ERC)

Who is eligible?

Your eligibility as an employer is based on gross receipts of less than 80% (versus less than 50%) compared to the same quarter in 2019. This means if your gross receipts decline more than 20% in 2021, you are eligible to take the credit.

How is the credit calculated?

For 2021, the Employee Retention Credit is equal to 70% of qualified employee wages paid in a calendar quarter. Eligible wages per employee max out at $10,000 per calendar quarter in 2021, so the maximum credit for eligible wages paid to any employee during 2021 is $28,000. The calculations can be tricky.

How do I claim 2020 ERC?

An eligible employer may file a claim for refund or make an interest-free adjustment by filing Form 941-X, Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund, for a past calendar quarter to claim the ERC to which it was entitled on qualified wages paid in that past calendar quarter, following the rules and procedures for making those claims or adjustments.

Significantly, it made it so that an employer that did not take an ERC for 2020 because it or its controlled member received a PPP loan may now be eligible for ERCs for 2020. Now, as of the March 11 passage of the American Rescue Plan Act, the ERC is available for all four quarters of 2021.

What You Need to Know About the Child Tax Credit Advance

Starting in July of 2021, eligible families will receive monthly payments of $250 for every child aged 6 through 17. Cash from the federal government with no spending restrictions will be popping up in bank accounts as Americans shore up their finances in the pandemic.

Sounds like another stimulus check, right? Wrong.

It’s the start of advance payments under the expanded Child Tax Credit (CTC). Eligible families will get $250 for every child age 6 through 17, between July and December. Families will get $300 per child for every kid under age 6. The first payments will go out July 15 and the IRS will continue to issue payments in middle of each month through the end of 2021. The credit has been paying families in lump sums at tax time for more than two decades. But earlier this year, Congress gave a one-time boost to the amount, broadened eligibility and enabled payments in advance monthly installments.

Federal lawmakers made these changes when passing the $1.9 trillion American Rescue Plan, a bill that also authorized $1,400 economic impact payments. This year, the credit increases from $2,000 to $3,600 for children under age 6 and $3,000 for kids between age 6 and 17. Half the sum can be advanced and distributed monthly. There are also many similarities between CTC money and stimulus checks. In both cases, there are no spending restrictions. Furthermore, households will receive the money if they fall under a certain income limit. The IRS determines stimulus checks and CTC payouts using tax-return data. Those income limits for full payment are the same for stimulus-check money and expanded CTC payouts. The thresholds are $75,000 a year for individuals, $150,000 a year for married couples filing jointly, and $112,500 a year for people like single parents who are filing as Head of Household.

In both cases, the IRS is looking at whichever recent tax return is available in a two-year window. For the third round of stimulus checks and the CTC, the tax collection agency is looking at 2020 returns, or 2019 returns if this year’s return isn’t yet available. But there are also important differences people need to remember now and at tax time.

To receive the Child Tax Credit, there must be a ‘qualifying minor’ in the house. In the past the IRS cut stimulus checks for all eligible children in a household, but it also cut checks to people without qualifying dependents. Without a minor living in the household, there will be no Child Tax Credit. But the person does not have to be your child, as long as he or she is a dependent. The child has to live in the household for more than a half of the year and be properly claimed as a dependent, the IRS said. It’s possible there are some people who haven’t been following the Child Tax Credit and won’t know what the money is.

The Child Tax Credit is based on ‘real-time’ eligibility

The IRS determined stimulus-check amounts based on one snapshot in time: a household’s tax return. A lot can happen in a year, but if a family had child after filing a tax return, the IRS didn’t have an immediate way to learn about the new dependent and quickly issue another payment. Unlike the stimulus check rollout, adjustments to the advance Child Tax Credit payments are going to have a more real-time feel. On Tuesday, the IRS unveiled its “Child Tax Credit Update Portal.” This is where users can actually opt out of payments and also give the IRS current information on the number of eligible kids in a house.

You may have to pay the Child Tax Credit money back

Talk of the portal and opting out brings up another big difference between stimulus checks and advance CTC money. Households paid too much CTC money in advance may have to pay it back, something that doesn’t happen with stimulus check money. The IRS is basing CTC payment amounts on 2019 and 2020 tax return data, but if someone in a household lands a better-paying job or a nice raise, that could push them out of income eligibility. If the IRS overpays, it will want the money back during the 2022 tax season. The IRS has said it will deduct the excess payment from refunds, but can work out installment plans for people who don’t have the funds to pay the balance due. (The IRS said it will waive repayment obligations in certain cases.) This is one big reason why the IRS is giving people the chance to opt out of the advance payments. The CTC advance payments also don’t have garnishment protections. “To the extent permitted by the laws of your state and local government, your advance Child Tax Credit payments may be subject to garnishment by your state, local government, and private creditors,” the IRS said.

The first payments go out July 15 and June 28 is the deadline to skip the July payment. Aug. 2 is the deadline to skip the Aug. 13 payment and Aug. 30 is the last day to skip the Sept. 15 payment. For now, someone cannot opt back into receiving the money after they have opted out. So, if that 2021 return ultimately reveals an overpayment after accounting for a taxpayer’s income and household situation, the IRS will want the excess money back. The IRS has said it will subtract the excess amount out of a taxpayer’s refund. If someone owes taxes, including the obligation for the CTC overpayment, the IRS says it can work out installment plans. If you are concerned you are going to hit the upper limit, why even take the risk? Just opt out. The worst that could happen is coming under the limit and getting the complete credit during tax season.

Too much income can put you on the hook for repayment!

Another set of people who should consider opting out are parents with older kids who were claimed as dependents in 2020 but will not be claimed as dependents in 2021. When deciding whether to opt out of the payments, part of a person’s challenge may be estimating how much money they’ll make in 2021 when there’s still six months to go. The IRS also launched an online tool that can help people determine their eligibility. Go to IRS.GOV and use the link for the Advance Child Tax Credit Eligibility Assistant.

Tax Changes and Key Amounts for the 2021 Tax Year

Americans are facing a long list of tax changes for the 2021 tax year. Smart taxpayers will start planning for them now.

Child Tax Credit:

The American Rescue Plan, which was enacted in March 2021, provides a dramatic, one-year expansion of the child tax credit for the 2021 tax year. One of the biggest changes is to the amount of the credit. For 2021, it jumps from $2,000 to $3,000 for most children – but to $3,600 for children 5 years old and younger. The extra amount ($1,000 or $1,600) is reduced – potentially to zero – for families with higher incomes, though. For people filing their tax return as a single person, the extra amount starts to phase-out if their adjusted gross income is above $75,000. The phase-out begins at $112,500 for head-of-household filers and $150,000 for married couples filing a joint return. The credit amount is further reduced under the pre-existing $200,000/$400,000 phase-out rules.

Another important change is that the 2021 credit is fully refundable. The $2,500-of-earned-income required is dropped for 2021, too. Children who are 17 years old also qualify for the 2021 credit.

Last but not least, half of the 2021 credit amount will be paid in advance through monthly payments starting on July 15. You’ll claim the other half of the credit on your 2021 tax return. You’ll also have to reconcile the monthly payments that you receive from the IRS in 2021 with the child tax credit that you are actually entitled to claim when you file your 2021 return. If the credit amount exceeds the total monthly payments, you can claim the excess credit on your return. But if the credit amount is less than the payments, you may or may not have to pay the excess back.

Although these enhancements only apply for the 2021 tax year, President Biden wants to extend most of them through 2025 and make the credit fully refundable on a permanent basis. However, whether that effort is ultimately successful remains to be seen.

Child and Dependent Care Tax Credit:

The American Rescue Plan also made significant improvements to the child and dependent care credit. But, again, the changes only apply to the 2021 tax year (although President Biden wants to make the enhancements permanent).

By way of comparison, the 2020 credit covered child and dependent care expenses for either (1) a dependent child under age 13 when the care was provided, or (2) a qualifying disabled dependent or spouse of any age that lived with you. The non-refundable credit was worth 20% to 35% of up to $3,000 in eligible expenses for one child/disabled person or $6,000 for two or more. The percentage decreased as income exceeded $15,000.

For 2021, the child and dependent care credit is fully refundable. The maximum credit percentage also jumps to 35% to 50%. More of your care expenses are available for the credit, too. For 2021, the credit is allowed for up to $8,000 in expenses for one child/disabled person and $16,000 for more than one. When the 50% maximum credit percentage is applied, that puts the top credit for the 2021 tax year at $4,000 if you have just one child/disabled person in your family and $8,000 if you have more.

In addition, the full child and dependent care credit will be allowed for families making less than $125,000 a year (instead of $15,000 per year). After that, the credit starts to phase-out. However, all families making between $125,000 and $438,000 will receive at least a partial credit.

Recovery Rebate Credit:

Americans were thrilled to learn that the American Rescue Plan Act authorized a third round of stimulus checks. Those checks were for $1,400, plus an additional $1,400 for each dependent in your family. However, some people didn’t receive that much (or anything) because the payments were phased out for joint filers with adjusted gross incomes above $150,000, head-of-household filers with an adjusted gross income (AGI) above $112,500, and single filers with an AGI above $75,000. In fact, third-round stimulus checks were reduced to zero if your AGI was above $160,000 (joint filers), $120,000 (head-of-household), or $80,000 (singles).

Unfortunately, some people who were eligible for a third-round stimulus check didn’t receive a payment or got less than what they should have received. For those people, relief may be available in the form of a 2021 tax credit known as the recovery rebate credit. Technically, your third stimulus check was an advance payment of the credit. So, when you file your 2021 return, you’ll have to reconcile the third stimulus check you received (if any) with the recovery rebate credit you’re entitled to claim. For most people, your third stimulus check payment will equal the tax credit allowed. In that case, your credit will be reduced to zero. However, if your third stimulus check was less than your credit amount, the tax you owe will be reduced by the difference (and you might even receive a refund). And if your third-round stimulus check was more than your credit amount, you won’t have to repay the difference to the IRS. (Also note that stimulus check payments are not taxable!)

Retirement Plans:

Required minimum distributions (RMDs) are back for 2021. Seniors were allowed to skip their RMDs in 2020 without having to pay a penalty. But the RMD suspension only applied for one year. So, anyone who is at least 72 years old by the end the year is required to take an RMD for 2021.

Many key dollar limits on retirement plans and IRAs remain the same for 2021. For example, the maximum contribution limits for 401(k), 403(b) and 457 plans stay at $19,500, while people born before 1972 can once again put in $6,500 more as a “catch-up” contribution. The 2021 cap on contributions to SIMPLE IRAs also stays the same at $13,500, plus an extra $3,000 for people age 50 and up.

The 2021 contribution limit for traditional IRAs and Roth IRAs also stays steady at $6,000, plus $1,000 as an additional catch-up contribution for individuals age 50 and up. However, the income ceilings on Roth IRA contributions went up. Contributions phase out in 2021 at adjusted gross incomes (AGIs) of $198,000 to $208,000 for couples and $125,000 to $140,000 for singles (up from $196,000 to $206,000 and $124,000 to $139,000, respectively, for 2020).

Deduction phaseouts for traditional IRAs also start at higher levels in 2021, from AGIs of $105,000 to $125,000 for couples and $66,000 to $76,000 for single filers (up from $104,000 to $124,000 and $65,000 to $75,000 for 20209). If only one spouse is covered by a plan, the phaseout zone for deducting a contribution for the uncovered spouse starts at $198,000 of AGI and ends at $208,000 (they were $196,000 and $206,000 for 2020).

Earned Income Tax Credit:

The American Rescue Plan expanded the 2021 EITC for childless workers in a few ways. First, it generally lowers the minimum age from 25 to 19 (except for certain full-time students). It also eliminates the maximum age limit (65), so older people without qualifying children can claim the 2021 credit, too. The maximum credit available for childless workers is also increased from $543 to $1,502 for the 2021 tax year. Expanded eligibility rules for former foster youth and homeless youth apply as well.

As with the 2020 EITC, you can also use your 2019 earned income instead of your 2021 income if that will boost your credit amount.

The enhancements described above are only for the 2021 tax year. However, there are also a few permanent EITC changes that take effect in 2021. For instance, workers who otherwise wouldn’t be able to claim the credit because their children can’t satisfy the identification requirements can now claim the childless EITC. Certain married but separated couples can now claim the EITC on separate tax returns, too. The limit on a worker’s investment income is also increased from $3,650 (for 2020) to $10,000 (adjusted for inflation after 2021).

Also note that President Biden wants to make the increase in the EITC parameters for workers without children and the expansion of age-eligibility permanent. Again, they only apply for the 2021 tax year right now.

Long-Term Capital Gains Tax Rates:

Tax rates on long-term capital gains (i.e., gains from the sale of capital assets held for at least one year) and qualified dividends did not change for 2021. However, the income thresholds to qualify for the various rates were adjusted for inflation.

In 2021, the 0% rate applies for individual taxpayers with taxable income up to $40,400 on single returns ($40,000 for 2020), $54,100 for head-of-household filers ($53,600 for 2020) and $80,800 for joint returns ($80,000 for 2020).

The 20% rate for 2021 starts at $445,851 for singles ($441,451 for 2020), $473,751 for heads of household ($469,051 for 2020) and $501,601 for couples filing jointly ($496,601 for 2020).

The 15% rate is for filers with taxable incomes between the 0% and 20% break points.

The 3.8% surtax on net investment income stays the same for 2021. It kicks in for single people with modified AGI over $200,000 and for joint filers with modified AGI over $250,000.

Note that President Biden wants long-term capital gains of anyone with an AGI of more than $1 million to be taxed at the ordinary income tax rates to the extent the person’s income exceeds $1 million ($500,000 for a married person filing a separate tax return).

Unemployment Compensation:

The American Rescue Plan Act made up to $10,200 of unemployment compensation ($20,400 for married couples filing jointly) exempt from federal income tax for households with an adjusted gross income less than $150,000 (refunds are being sent to people who filed their return before the exemption was enacted).

Unfortunately, the exemption only applied to unemployment compensation received in 2020. So, for 2021, Uncle Sam will once again fully tax unemployment compensation as if it were wages.

Charitable Gift Deductions:

For the 2020 tax year, a new “above-the-line” deduction was allowed for up to $300 of charitable cash contributions. Only people who claimed the standard deduction on their tax return (rather than claiming itemized deductions on Schedule A) could take this deduction.

The write-off was originally scheduled to expire after 2020, but it was later extended to 2021 – with one important enhancement. For 2020, one deduction was allowed per return, meaning married couples who filed jointly could only deduct $300, not $600. However, for 2021, one deduction is allowed per person, which means married couples can deduct up to $600 on a joint 2021 tax return.

The 2020 suspension of the 60%-of-AGI limit on deductions for cash donations by people who itemize was also extended through the 2021 tax year.

Student Loan Relief:

Normally, if a student loan is canceled, forgiven, or otherwise discharged for less than the amount you owe, the amount of canceled debt is considered taxable income. However, starting in 2021, this rule is suspended for most canceled student loan debt that was incurred for a post-secondary education. The change is only temporary, though. In 2026, forgiven student loan debt will once again be taxed.

The rule allowing workers to exclude up to $5,250 of college loans paid by their employer in 2020 from taxable wages was also extended through 2025. The $5,250 cap applies to both student loan repayment benefits and other educational assistance offered by an employer.

Adoption of a Child:

For 2021, the adoption credit can be taken on up to $14,440 of qualified expenses ($14,300 for 2020). The full credit is available for a special-needs adoption, even if it costs less. The credit begins to phase out for filers with modified AGIs over $214,520 and disappears at $254,520 ($214,520 and $254,520, respectively, for 2020).

The exclusion for company-paid adoption aid was also increased from $14,300 to $14,440 for 2021.

Estate & Gift Taxes:

The lifetime estate and gift tax exemption for 2020 jumped from $11.58 million to $11.7 million — $23.4 million for couples if portability is elected by timely filing IRS Form 706 after the death of the first-to-die spouse. The estate tax rate remains steady at 40%.

The gift tax exclusion remains $15,000 per recipient. So, you can give up to $15,000 ($30,000 if your spouse agrees) to each child, grandchild or any other person in 2021 without having to file a gift tax return or tap your lifetime estate and gift tax exemption.

Education Tax Breaks:

Unfortunately, the tuition and fees deduction has been repealed beginning with the 2021 tax year. That “above-the-line” write-off was worth up to $4,000.

However, to balance out the loss of the tuition and fees deduction, the phase-out thresholds for the lifetime learning credit were permanently increased. For the 2020 tax year, the credit was gradually reduced to zero for joint filers with a modified AGI from $118,000 to $138,000 and single filers with a modified AGI between $59,000 and $69,000. Beginning in 2021, the phase-out range for married couples filing a joint return is $160,000 to $180,000, and it’s $80,000 to $90,000 for single filers. (The same phase-out ranges apply to the American Opportunity tax credit.)

The income caps are also higher in 2021 for tax-free EE bonds used for education. The exclusion starts phasing out above $124,800 of modified AGI for couples and $83,200 for others ($123,550 and $82,350 for 2020). It ends at modified AGI of $154,800 and $98,200, respectively ($153,550 and $97,350 for 2020). The savings bonds must be redeemed to help pay for tuition and fees for college, graduate school or vocational school for the taxpayer, spouse or a dependent.

Americans Working Abroad:

U.S. taxpayers working abroad have a larger income exclusion in 2021. It jumped from $107,600 for 2020 to $108,700 for 2021. (Taxpayers claim the foreign earned income exclusion on Form 2555.)

The standard ceiling on the foreign housing exclusion is also increased from $15,064 to $15,218 for 2021 (although overseas workers in many high-cost locations around the world qualify for a significantly higher exclusion).

Payroll Taxes:

The Social Security annual wage base is $142,800 for 2021 (that’s a $5,100 hike from 2020). The Social Security tax rate on employers and employees stays at 6.2%. Both workers and employers continue to pay the 1.45% Medicare tax on all compensation in 2021, with no cap. Workers also pay the 0.9% Medicare surtax on 2021 wages and self-employment income over $200,000 for singles and $250,000 for couples. The surtax doesn’t hit employers, though.

In August 2020, Donald Trump issued an executive memorandum allowing employers to suspend the collection and payment of Social Security payroll taxes from September 1 until the end of 2020 for workers making less than $4,000 for any bi-weekly pay period (i.e., $2,000 per week, or $104,000 per year). The president’s action didn’t eliminate the tax debt — it just delayed withholding and payment of the tax — and it was optional. If your employer suspended payroll taxes in 2020, it must collect the deferred taxes from your paycheck by December 31, 2021. So, during 2021, some workers will have more withheld from their paychecks for the 6.2% Social Security tax.

The nanny tax threshold went up to $2,300 for 2021, which was a $100 increase from 2020.

Standard Mileage Rates:

The 2021 standard mileage rate for business driving fell from 57.5¢ to 56¢ a mile. The mileage allowance for medical travel and military moves also declined from 17¢ to 16¢ a mile in 2021. However, the charitable driving rate stayed put at 14¢ a mile — it’s fixed by law.

Long- Term Care Insurance Premiums:

The limits on deducting long-term care insurance premiums are higher in 2021. Taxpayers who are age 71 or older can write off as much as $5,640 per person ($5,430 for 2020). Filers age 61 to 70 can deduct up to $4,520 ($4,350 for 2020). Anyone who is 51 to 60 can deduct up to $1,690 ($1,630 for 2020). For people age 41 to 50, the max is $850 ($810 for 2020). Finally, for whippersnappers age 40 and younger, it’s $450 ($430 for 2020). For most, long-term care premiums are medical expenses deductible only by itemizers on Schedule A. However, self-employed people can deduct them on Schedule 1 of the 1040.

Health Savings Accounts (HSAs):

The annual cap on deductible contributions to health savings accounts (HSAs) rose in 2021 from $3,550 to $3,600 for self-only coverage and from $7,100 to $7,200 for family coverage. People born before 1967 can put in $1,000 more (same as for 2020).

Qualifying insurance policies must limit out-of-pocket costs in 2021 to $14,000 for family health plans ($13,800 in 2020) and $7,000 for people with individual coverage ($6,900 in 2019). Minimum policy deductibles remain at $2,800 for families Flexible Spending Accounts (FSAs) and $1,400 for individuals.

Flexible Spending Accounts (FSAs):

Health and dependent care flexible spending accounts (FSAs) generally run on an annual use-it-or-lose-it basis. There are limits to the amount you can contribute each year, too. However, because of difficulties some families faced when trying to use and manage their FSAs during the pandemic, some temporary rules were put in place to add even more flexibility to FSAs. For example, instead of losing unused FSA funds at the end of the year, employers can modify their FSA plans to allow a worker’s unused funds from 2020 to be used in 2021 and unused funds from 2021 to be used in 2022.

As an alternative, employers are permitted to extend the grace period for using FSA funds after the end of the year. Normally, FSA plans can offer a grace period of up to 2½ months (i.e., to March 15). However, a grace period of up to 12 months is allowed for using 2020 and 2021 FSA funds.

Unused amounts carried over from a prior year or available during an extended grace period won’t be taken into account in determining the annual contribution limit for the following year. That means the funds that continue to be available are still excluded from the employee’s taxable income if used for dependent care expenses.

Workers can also contribute more to a dependent care FSA in 2021. Instead of the normal $5,000-per-year limit on tax-free contributions, a family can sock away up to $10,500 in a dependent care FSA in 2021 without paying tax on the contributions.

Employers are also allowed to extend the maximum age of eligible dependents from 12 to 13 for dependent care FSAs for unused amounts from the 2020 plan year carried over into 2021.

Premium Tax Credit:

The premium tax credit helps eligible Americans cover the premiums for health insurance purchased through an Obamacare exchange (e.g., HealthCare.gov). The American Rescue Plan enhanced the credit for 2021 and 2022 to lower premiums for people who buy coverage on their own. First, it increases the credit amount for eligible taxpayers by reducing the percentage of annual income that households are required to contribute toward the premium. It also allows the credit to be claimed by people with an income above 400% of the federal poverty line.

In addition, when insurance is purchased through an exchange, eligible people can choose to have an estimated credit amount paid in advance to their insurance company so that less money comes out of their own pocket to pay monthly premiums. Then, when they complete their tax return, the calculated credit is compared it to the advance payments. If the advance payments are greater than the actual allowable credit, the difference (subject to certain repayment caps) must be paid back either by subtracting the difference from a tax refund or adding it to the tax owed. The American Rescue Plan suspended the repayment of excess advanced payments of the premium tax credit…but only for the 2020 tax year. So, advance payments in 2021 that exceed the credit amount on your 2021 tax return will have to be repaid.

Alternative Minimum Tax (AMT):

There’s good news for anyone worried about getting hit with the alternative minimum tax: AMT exemptions ticked upward for 2021. They increased from $113,400 to $114,600 for couples and from $72,900 to $73,600 for single filers and heads of household. The phaseout zones for the exemptions start at higher income levels as well — $1,047,200 for couples and $523,600 for singles and household heads ($1,036,800 and $518,400, respectively, for 2020).

In addition, the 28% AMT tax rate kicked in a bit higher in 2021 — above $199,900 of alternative minimum taxable income. The rate applied to AMTI over $197,900 for 2020.

Self-Employed People:

If you’re self-employed, there are some additional 2021 tax law changes that could impact your bottom line. For example, a key dollar threshold on the 20% deduction for pass-through income was increased for 2021. Self-employed people and owners of LLCs, S corporations and other pass-through entities can deduct 20% of their qualified business income, subject to limitations for individuals with taxable incomes in excess of $329,800 for joint filers and $164,900 for others ($326,600 and $163,300, respectively, for 2020).

In addition, tax credits that were allowed in 2020 for self-employed people who couldn’t work for a reason that would have entitled them to pandemic-related sick or family leave if they were an employee have been extended to cover leave through September 30, 2021. The number of days for which self-employed people can claim the credit for family leave was also increased from 50 to 60, and the 10-day limit on the maximum number of days for which a self-employed person can claim the sick leave credit was reset to begin again on January 1, 2021.

Other changes that self-employed Americans need to know about include:

- The deduction for business meals is increased from 50% to 100% for 2021 and 2022;

- Self-employment taxes cannot be deferred in 2021 as they were in 2020; and

- The $250,000 cap on deductible business losses ($500,000 for joint filers) is back in play after being suspended for the 2018 to 2020 tax years.

What You Need To Know About Social Security

Social Security is an important piece of just about everyone’s retirement pie, but the rules for claiming it make it challenging to give clients the best advice. Unfortunately, there’s no one-size-fits-all approach. The following is some information you might find useful in your decision making regarding when to begin taking your benefits.

Cheat On Your Taxes, Get IRS Penalties; Obstruct IRS, Get Jail

No one likes paying taxes, and no one likes being audited. If you are audited, you should hire someone to represent you as there are risks in handling it yourself. For one thing, most criminal IRS cases come out of regular old civil audits and even simple interactions can go south. A good example of how to land yourself in hot water is if you engage in deceptive or obstructionist behavior with the IRS. Some people think they can outsmart the IRS and cover something up. The coverup can be worse than the crime.

Time and again, in serious tax cases, a person may think that preparing false invoices, fake receipts, and made-up expenses can get them out of trouble. Usually, the reverse is true. It is one reason why talking to the IRS in an audit or investigation can be dangerous.

What if you misspeak? Curiously, claiming Fifth Amendment protection in tax cases can be a mistake. One of the biggest issues involves books and records. You must keep them in order to fulfill your tax filing obligations. If those records are incriminating, can you refuse to hand them over? You can, but it may not help. Even if you claim the Fifth Amendment protection against self-incrimination, the IRS can hand you an “information document request” to produce your records.

You can refuse, but the IRS will then issue a summons. If you refuse to answer that, the IRS will take you to court, and the court will probably order you to comply. But doesn’t your constitutional right to take the Fifth trump the IRS? Not always. Ironically, you can refuse to talk, but you may not be able to refuse to produce documents. Your own private papers are personal records, and if they might incriminate you, they are protected by the Fifth Amendment. But the Required Records doctrine says you must still hand over documents no matter how incriminating. The government requires you to keep certain records, and the government has a right to inspect them.

In most cases, a tax audit is civil and there is little risk that it will become otherwise. Yet most criminal tax cases come directly out of civil tax audits. The IRS civil auditors ‘refer’ a case to the IRS Criminal Investigation Division. The IRS civil auditor will not tell you this is occurring, so the first time you hear about it, your case may have gone from bad to worse.

A Discussion Regarding Tax Filing Penalties

The failure-to-file penalty is assessed if there is unpaid tax and the taxpayer fails to file a tax return or request an extension by the April due date. This penalty is usually 5% of tax for the year that’s not paid by the original return due date. The penalty is charged for each month or part of a month that a tax return is late. But, if the return is more than 60 days late, there is a minimum penalty, either $210 or 100 percent of the unpaid tax, whichever is less.

Special filing deadline rules

Special deadlines affect penalty and interest calculations for those who qualify, such as members of the military serving in combat zones, taxpayers living outside the U.S., and those living in declared disaster areas.

Taxpayers in a combat zone may be able to further extend the filing deadline and can find details in Publication 3, Armed Forces’ Tax Guide (PDF). For taxpayers living and working outside the U.S. and Puerto Rico, or on military duty, the deadline to file is June 17. They also have until June 17 to file Form 4868 for an extension until October 15. An extension of time to file is not an extension of time to pay any tax due.

When the president declares a major disaster, the IRS can postpone certain deadlines for taxpayers who reside or have a business in the impacted area. If an affected taxpayer receives a late filing or late payment penalty notice from the IRS, and they filed or paid by the deadline stated in the IRS news release of postponement of the deadlines for filing and/or paying, they should call the telephone number on the notice to see if IRS can abate the penalty due to the disaster.

Penalty relief may be available

Taxpayers who have filed and paid on time and have not been assessed any penalties for the past three years often qualify to have the penalty abated. See the First-Time Penalty Abatement page on IRS.gov. A taxpayer who does not qualify for the first-time penalty relief may still qualify for penalty relief if their failure to file or pay on time was due to reasonable cause and not due to willful neglect. Taxpayers should read the penalty notice and follow its instructions to request this relief.

In addition to penalties, interest will be charged on any tax not paid by the regular April due date. For individual taxpayers it is the federal short-term interest rate plus 3 percentage points, compounded daily. Interest stops accruing as soon as the tax is paid in full. Interest cannot be abated.

Payment options

Many taxpayers delay filing because they are unable to pay what they owe. Often, these taxpayers qualify for one of the payment options available from the IRS. Taxpayers can use their online account to view the amount they owe, make payments and apply for an online payment agreement. These include:

Installment Agreement — Individuals who owe $50,000 or less in combined tax, penalties and interest can request a payment plan using the IRS’s Online Payment Agreement application. Those who have a balance under $100,000 may also qualify for a short-term agreement. An installment agreement, or payment plan can usually be set up in minutes. Requesters receive immediate notification of approval. Visit Payment Plans, Installment Agreements at IRS.gov for more information.

Offer in Compromise — Struggling taxpayers may qualify to settle their tax bill for less than the full amount owed by submitting an offer in compromise. To help determine eligibility, use the Offer in Compromise Pre-Qualifier tool.

Check withholding

Taxpayers who owe tax for 2020 can avoid having the same problem for 2021 by increasing the amount of tax withheld from their paychecks. For help determining the right amount to withhold, use the Withholding Calculator on IRS.gov

Need Assistance with Your Taxes?

BJ Militello can help! Call 1-954-240-2635 to learn more.

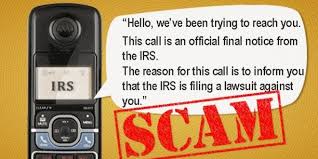

IRS PHISHING SCAMS YOU NEED TO PAY ATTENTION TO! And, new Covid-19 Related Scams.

The SSN hustle. The latest twist includes scammers claiming to be able to suspend or cancel the victim’s Social Security number. In this variation, the Social Security cancellation threat scam is similar to and often associated with the IRS impersonation scam. It is yet another attempt by con artists to frighten people into returning ‘robocall’ voicemails. Scammers may mention overdue taxes in addition to threatening to cancel the person’s SSN.

Fake tax agency. This scheme involves the mailing of a letter threatening an IRS lien or levy. The lien or levy is based on bogus delinquent taxes owed to a non-existent agency, “Bureau of Tax Enforcement.” There is no such agency. The lien notification scam also likely references the IRS to confuse potential victims into thinking the letter is from a legitimate organization.

Both display classic signs of being scams. The IRS and its Security Summit partners – the state tax agencies and the tax industry – remind everyone to stay alert to scams that use the IRS or reference taxes, especially in late spring and early summer as tax bills and refunds arrive.

Phone Scams. The IRS does not leave pre-recorded, urgent or threatening messages. In many variations of the phone scam, victims are told if they do not call back, a warrant will be issued for their arrest. Other verbal threats include law-enforcement agency intervention, deportation or revocation of licenses.

Criminals can fake or “spoof” caller ID numbers to appear to be anywhere in the country, including from an IRS office. This prevents taxpayers from being able to verify the true call number. Fraudsters also have spoofed local sheriff’s offices, state departments of motor vehicles, federal agencies and others to convince taxpayers the call is legitimate.

Email phishing scams. The IRS does not initiate contact with taxpayers by email to request personal or financial information. The IRS initiates most contacts through regular mail delivered by the United States Postal Service. However, there are special circumstances when the IRS will call or come to a home or business. These visits include times when a taxpayer has an overdue tax bill, a delinquent tax return or a delinquent employment tax payment, or the IRS needs to tour a business as part of a civil investigation (such as an audit or collection case) or during criminal investigation.

If a taxpayer receives an unsolicited email that appears to be from either the IRS or a program closely linked to the IRS that is fraudulent, report it by sending it to

ph******@ir*.gov

. The Report Phishing and Online Scams page provides complete details

Telltale signs of a scam

The IRS (and its authorized private collection agencies) will never:

· Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. The IRS does not use these methods for tax payments. Generally, the IRS will first mail a bill to any taxpayer who owes taxes. All tax payments should only be made payable to the U.S. Treasury and checks should never be made payable to third parties.

· Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying.

· Demand that taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed.

· Ask for credit or debit card numbers over the phone.

For anyone who doesn’t owe taxes and has no reason to think they do:

· Do not give out any information. Hang up immediately.

· Contact the Treasury Inspector General for Tax Administration to report the call. Use their IRS Impersonation Scam Reporting web page.

· Report the caller ID and/or callback number to the IRS by sending it to

ph******@ir*.gov

(Subject: IRS Phone Scam).

· Report it to the Federal Trade Commission. Use the FTC Complaint Assistant on FTC.gov. Add “IRS Telephone Scam” in the notes.

For anyone who owes tax or thinks they do:

· View tax account information online at IRS.gov to see the actual amount owed. Taxpayers can then also review their payment options.

· Call the number on the billing notice, or

· Call the IRS at 800-829-1040. IRS workers can help.

The IRS does not use text messages or social media to discuss personal tax issues, such as those involving bills or refunds. For more information, visit the Tax Scams and Consumer Alerts page on IRS.gov. Additional information about tax scams is also available on IRS social media sites, including YouTube videos.

Pandemic Related Scams:

Scammers change their methods frequently. Current coronavirus scams include:

- Identity theft when people post a photo of their vaccination card on social media. Don’t post a photo of your vaccination card online. Scammers can see and steal your name, birthdate, and other personal information.

- COVID-19 testing, vaccine, and treatment scams – Don’t trust offers to get early access to the approved vaccine. And be aware that scammers are also targeting Medicare recipients. They’re offering COVID-19 testing in an attempt to steal personal information.

- Charity scams – Fake charities pop up during disasters. And scammers can also claim to be from real charities. Learn how to research charity claims and protect your money.

- Checks from the government – Scammers say they’re from the IRS or another government agency. They ask for your personal information or try to charge you fake fees for getting your stimulus check or offer you a way to get the money early.

- FDIC and banking – People pretend to call from the Federal Deposit Insurance Corporation (FDIC) or your bank. They say your bank account or your ability to get cash are in danger and ask for your personal information.

- Grandparent and military service member scams – A scammer pretends to be a grandchild or a military service member. They say they’re sick or in trouble because of the coronavirus. They contact you asking to wire them money to pay for fake medical or travel expenses.

- Covid-19 funeral assistance scam – Scammers pretend to be from FEMA’s COVID-19 Funeral Assistance Program and call to offer program registration to family members of people who have died from COVID-19. In this way, the scammers can steal the family members’ Social Security numbers and other forms of identification.

- Because of the COVID-19 pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

Report COVID–19 Scams

- Contact the National Center for Disaster Fraud hotline at 866-720-5721 or email

di******@le*.gov

. - Report a scam to the FBI at tips.fbi.gov.

- If it’s an online scam, submit your complaint through the Internet Crime Complaint Center (IC3).

Report Price Gouging

During times of high demand, sellers may raise prices to a very high and unfair level on needed items like:

- Face masks

- Hand sanitizer

- Household or personal care items

This is called price gouging and it’s illegal. If you suspect price gouging, report it to your state attorney general.

For more information or assistance in dealing with the IRS, contact BJ Militello at 954-240-2635.