-

Senate Democrats on Sunday passed their climate, health and tax package, including nearly $80 billion in funding for the IRS.…

-

Cum sociis natoque penatibus et magnis dis parturient montes, nascetur ridiculus mus. Cras mattis consectetur purus sit amet fermentum.

-

No one likes paying taxes, and no one likes being audited. If you are audited, you should hire someone to…

-

The failure-to-file penalty is assessed if there is unpaid tax and the taxpayer fails to file a tax return or…

-

1. Double check your withholding and estimated taxes. The individual tax changes cut both ways. You may be familiar with the…

-

The Red Flags You Should Know About! No one likes to receive the “Dear Taxpayer” letter so, here are some…

-

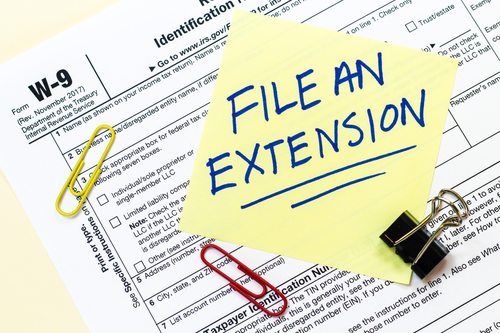

I am sure that every accountant has heard the words “put my tax return on extension” upon advising a client…