IRS PHISHING SCAMS YOU NEED TO PAY ATTENTION TO! And, new Covid-19 Related Scams.

The SSN hustle. The latest twist includes scammers claiming to be able to suspend or cancel the victim’s Social Security number. In this variation, the Social Security cancellation threat scam is similar to and often associated with the IRS impersonation scam. It is yet another attempt by con artists to frighten people into returning ‘robocall’ voicemails. Scammers may mention overdue taxes in addition to threatening to cancel the person’s SSN.

Fake tax agency. This scheme involves the mailing of a letter threatening an IRS lien or levy. The lien or levy is based on bogus delinquent taxes owed to a non-existent agency, “Bureau of Tax Enforcement.” There is no such agency. The lien notification scam also likely references the IRS to confuse potential victims into thinking the letter is from a legitimate organization.

Both display classic signs of being scams. The IRS and its Security Summit partners – the state tax agencies and the tax industry – remind everyone to stay alert to scams that use the IRS or reference taxes, especially in late spring and early summer as tax bills and refunds arrive.

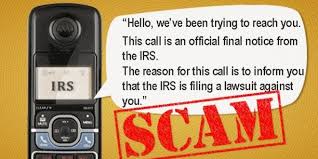

Phone Scams. The IRS does not leave pre-recorded, urgent or threatening messages. In many variations of the phone scam, victims are told if they do not call back, a warrant will be issued for their arrest. Other verbal threats include law-enforcement agency intervention, deportation or revocation of licenses.

Criminals can fake or “spoof” caller ID numbers to appear to be anywhere in the country, including from an IRS office. This prevents taxpayers from being able to verify the true call number. Fraudsters also have spoofed local sheriff’s offices, state departments of motor vehicles, federal agencies and others to convince taxpayers the call is legitimate.

Email phishing scams. The IRS does not initiate contact with taxpayers by email to request personal or financial information. The IRS initiates most contacts through regular mail delivered by the United States Postal Service. However, there are special circumstances when the IRS will call or come to a home or business. These visits include times when a taxpayer has an overdue tax bill, a delinquent tax return or a delinquent employment tax payment, or the IRS needs to tour a business as part of a civil investigation (such as an audit or collection case) or during criminal investigation.

If a taxpayer receives an unsolicited email that appears to be from either the IRS or a program closely linked to the IRS that is fraudulent, report it by sending it to phishing@irs.gov. The Report Phishing and Online Scams page provides complete details

Telltale signs of a scam

The IRS (and its authorized private collection agencies) will never:

· Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. The IRS does not use these methods for tax payments. Generally, the IRS will first mail a bill to any taxpayer who owes taxes. All tax payments should only be made payable to the U.S. Treasury and checks should never be made payable to third parties.

· Threaten to immediately bring in local police or other law-enforcement groups to have the taxpayer arrested for not paying.

· Demand that taxes be paid without giving the taxpayer the opportunity to question or appeal the amount owed.

· Ask for credit or debit card numbers over the phone.

For anyone who doesn’t owe taxes and has no reason to think they do:

· Do not give out any information. Hang up immediately.

· Contact the Treasury Inspector General for Tax Administration to report the call. Use their IRS Impersonation Scam Reporting web page.

· Report the caller ID and/or callback number to the IRS by sending it to phishing@irs.gov (Subject: IRS Phone Scam).

· Report it to the Federal Trade Commission. Use the FTC Complaint Assistant on FTC.gov. Add “IRS Telephone Scam” in the notes.

For anyone who owes tax or thinks they do:

· View tax account information online at IRS.gov to see the actual amount owed. Taxpayers can then also review their payment options.

· Call the number on the billing notice, or

· Call the IRS at 800-829-1040. IRS workers can help.

The IRS does not use text messages or social media to discuss personal tax issues, such as those involving bills or refunds. For more information, visit the Tax Scams and Consumer Alerts page on IRS.gov. Additional information about tax scams is also available on IRS social media sites, including YouTube videos.

Pandemic Related Scams:

Scammers change their methods frequently. Current coronavirus scams include:

- Identity theft when people post a photo of their vaccination card on social media. Don’t post a photo of your vaccination card online. Scammers can see and steal your name, birthdate, and other personal information.

- COVID-19 testing, vaccine, and treatment scams – Don’t trust offers to get early access to the approved vaccine. And be aware that scammers are also targeting Medicare recipients. They’re offering COVID-19 testing in an attempt to steal personal information.

- Charity scams – Fake charities pop up during disasters. And scammers can also claim to be from real charities. Learn how to research charity claims and protect your money.

- Checks from the government – Scammers say they’re from the IRS or another government agency. They ask for your personal information or try to charge you fake fees for getting your stimulus check or offer you a way to get the money early.

- FDIC and banking – People pretend to call from the Federal Deposit Insurance Corporation (FDIC) or your bank. They say your bank account or your ability to get cash are in danger and ask for your personal information.

- Grandparent and military service member scams – A scammer pretends to be a grandchild or a military service member. They say they’re sick or in trouble because of the coronavirus. They contact you asking to wire them money to pay for fake medical or travel expenses.

- Covid-19 funeral assistance scam – Scammers pretend to be from FEMA’s COVID-19 Funeral Assistance Program and call to offer program registration to family members of people who have died from COVID-19. In this way, the scammers can steal the family members’ Social Security numbers and other forms of identification.

- Because of the COVID-19 pandemic, many taxpayers lost their jobs and received unemployment compensation from their state. However, scammers also took advantage of the pandemic by filing fraudulent claims for unemployment compensation using stolen personal information of individuals who had not filed claims. Payments made on these fraudulent claims went to the identity thieves.

Report COVID–19 Scams

- Contact the National Center for Disaster Fraud hotline at 866-720-5721 or email disaster@leo.gov.

- Report a scam to the FBI at tips.fbi.gov.

- If it’s an online scam, submit your complaint through the Internet Crime Complaint Center (IC3).

Report Price Gouging

During times of high demand, sellers may raise prices to a very high and unfair level on needed items like:

- Face masks

- Hand sanitizer

- Household or personal care items

This is called price gouging and it’s illegal. If you suspect price gouging, report it to your state attorney general.

For more information or assistance in dealing with the IRS, contact BJ Militello at 954-240-2635.

What has happened recently which affects tax filing season 2021!

- Many tax provisions are set to expire or change starting in 2021 – how might this shape tax policy?

When Congress enacts tax changes, they may be only temporary, and in larger bills, lawmakers sometimes include “sunsets” or future modifications that help reduce the overall cost of the legislation. Examples can be found in the tax provisions commonly known as “tax extenders,” as well as in recent legislation such as the Tax Cuts and Jobs Act (TCJA) and the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

While the recently enacted Consolidated Appropriations Act, 2021, made some tax extenders permanent, it extended other key ones through 2025, including the controlled foreign corporation look-through rule and the Work Opportunity Tax Credit. The expiration date of these tax extenders now aligns with sunset of several key TCJA provisions.

The fate of these tax provisions, and the revenue implications associated with them, have the potential to shape tax policy ─ and they may show up in different pieces of legislation throughout the congressional session. Some have bipartisan support. As such, businesses that have an interest in these provisions should be aware of the changes, model out the potential impacts and consider engaging with policymakers as appropriate.

Tax “Extenders”:

There’s a group of tax breaks that are constantly scheduled to expire, but that keep getting extended by Congress for another year or two. These tax breaks are collectively referred to as “tax extenders.”

Several of the “tax extender” deductions and credits were set to expire after 2020…but guess what happened. Yep, Congress kicked the can down the road once again and renewed many of them on a temporary basis. Most of the extended tax breaks are for businesses, but several of them impact individual taxpayers.

Tax breaks for individuals that were extended until the end of 2021 include the:

- Mortgage insurance premiums deduction;

- Health coverage tax credit for medical insurance premiums paid by certain Trade Adjustment Assistance recipients and people whose pension plans were taken over by the Pension Benefit Guaranty Corporation;

- Nonbusiness energy property credit for certain energy-saving improvements to your home (e.g., new energy-efficient windows and skylights, exterior doors, roofs, insulation, heating and air conditioning systems, water heaters, etc.);

- Fuel cell motor vehicle credit;

- Alternative fuel vehicle refueling property credit; and

- Two-wheeled plug-in electric vehicle credit.

The exclusion for forgiven mortgage debt was also renewed through 2025 (although the maximum amount that can be excluded is reduced from $2 million to $750,000).

In addition, the 26% rate for the residential energy efficient property credit was extended through 2022 (the credit applies to the cost of solar electric property, solar water heaters, geothermal heat pumps, small wind turbines, fuel cell property, and qualified biomass fuel property). The rate was previously scheduled to drop to 22% in 2021, but now it won’t be reduced until 2023. The credit is then set to expire after 2023.

Two tax breaks for individuals were made permanent, too. First, the 7.5%-of-AGI threshold for deducting medical expenses won’t be raised. It was scheduled to jump to 10% after 2020. The exclusion for state or local tax benefits and reimbursement payments provided to volunteer firefighters and emergency medical responders is now a permanent tax break as well.

I